The Definitive Guide for Special Assessments Florida

A special analysis is an additional tax obligation on a piece of property, usually in the form of real estate tax obligations. This added analysis is gathered by the local challenging authority and routed to an assigned fund to fund jobs, renovations or programs for the assessed area. Unique assessment districts are an usual advancement financing tool.

Most states provide more than one alternative. These devices are known by a variety of names as well as can be structured in a range of means, however there are two primary methods. The initial method, Company and Community Areas, is the setting up of business and also area teams into an area to produce financing for projects as well as programs.

The Greatest Guide To Special Assessments Florida

A Review of Unique Function Tiring DistrictsMembers only Login The National Association of House Builders published this record focusing on Special Purpose Straining Areas, a more reliable and effective way to fund public enhancements ahead of development, while at the very same time ensuring that brand-new development spends for the renovations (special assessments florida).

The Tax Obligation Increment Money Referral Overview addresses what TIF is, why it ought to be made use of and also exactly how best to use the TIF tool. The reference overview likewise highlights both TIF as well as special assessment jobs from across the nation as well as goes over exactly how they can be applied to resolve numerous usual financial development concerns.

The charge just uses to those residential properties which will certainly profit from the enhancement. Either entity will certainly initiate the procedure by taking a proposition to whoever is in cost of levying analyses locally.

Special Assessments Florida for Beginners

The cash collected via unique analyses can money the building of drains, streets, drainage, and also watering. Furthermore, special assessments can be used to fund the development of parks and recreational centers.

The bigger the front-foot measurement of a lot, the greater the evaluation the lot proprietor will certainly pay. The front-foot dimension of a whole lot is each foot of a great deal that abuts the road being improved. On the other hand, it might be allocated on a fractional basis, where the cost of an enhancement is shared similarly by those influenced.

Special assessments are usually repaid in installations over lots of years. Nevertheless, the home owner does have the alternative to settle the balance completely, which would lower the amount of passion they may be billed gradually. special assessments florida. Yes, they are. Unique Assessments are always taken into consideration to be certain.

Some Known Factual Statements About Special Assessments Florida

Such audits shall be conducted in accordance with generally accepted bookkeeping standards as well as accordingly shall consist of examinations of the audit records as well as various other bookkeeping procedures as might be taken into consideration essential under the conditions. Whether economic reports and related items, such as components, accounts, or check that funds are rather provided,2.

:max_bytes(150000):strip_icc()/0999d52f-3742-408e-b602-9f747ad59781-large-56a1bcc45f9b58b7d0c2251e.jpeg)

Please contact, Replacement Auditor-Controller Get in touch with your department pay-roll staff to request a duplicate. Call (707) 784-6284 and also supply a social protection number as well as name. We can confirm details you already have yet can not supply any type of new details.

This rate is continuous as ensured under Proposal 13 come on 1978. What this implies is that a $1 tax obligation is imposed for every single $100 examined value of the home. Furthermore, under the stipulations of Suggestion 13, any type of tax obligations levied by any type of governmental firm in addition to the 1% must be authorized by 66 2/3% of the voters.

Special Assessments Florida - Questions

Any kind of rate you will browse around here certainly see in your tax expense added to the 1%, stands for a financial debt or financial obligations approved by the citizens. In Solano County, most of the real estate tax brings a citizen's financial obligation. The citizen's financial debt rates are not consistent throughout the county since these are reliant on the round of influence of each firm that levies it.

These entities include the region, colleges, cities, collections, and also special districts. The tax levied to any type of building is shared by a combination of any of the entities discussed in the foregoing that solution the location where the residential property being taxed is located.

If any of the foregoing occasions will certainly result in a reduction in examined value, an additional refund instead of a tax obligation is created. No. It is a single modification. It just happens when there is a change of ownership or a brand-new building and construction task is finished. In a couple of circumstances, damage of building as a result of acts of nature might cause a negative change that might result to an additional refund.

The Best Guide To Special Assessments Florida

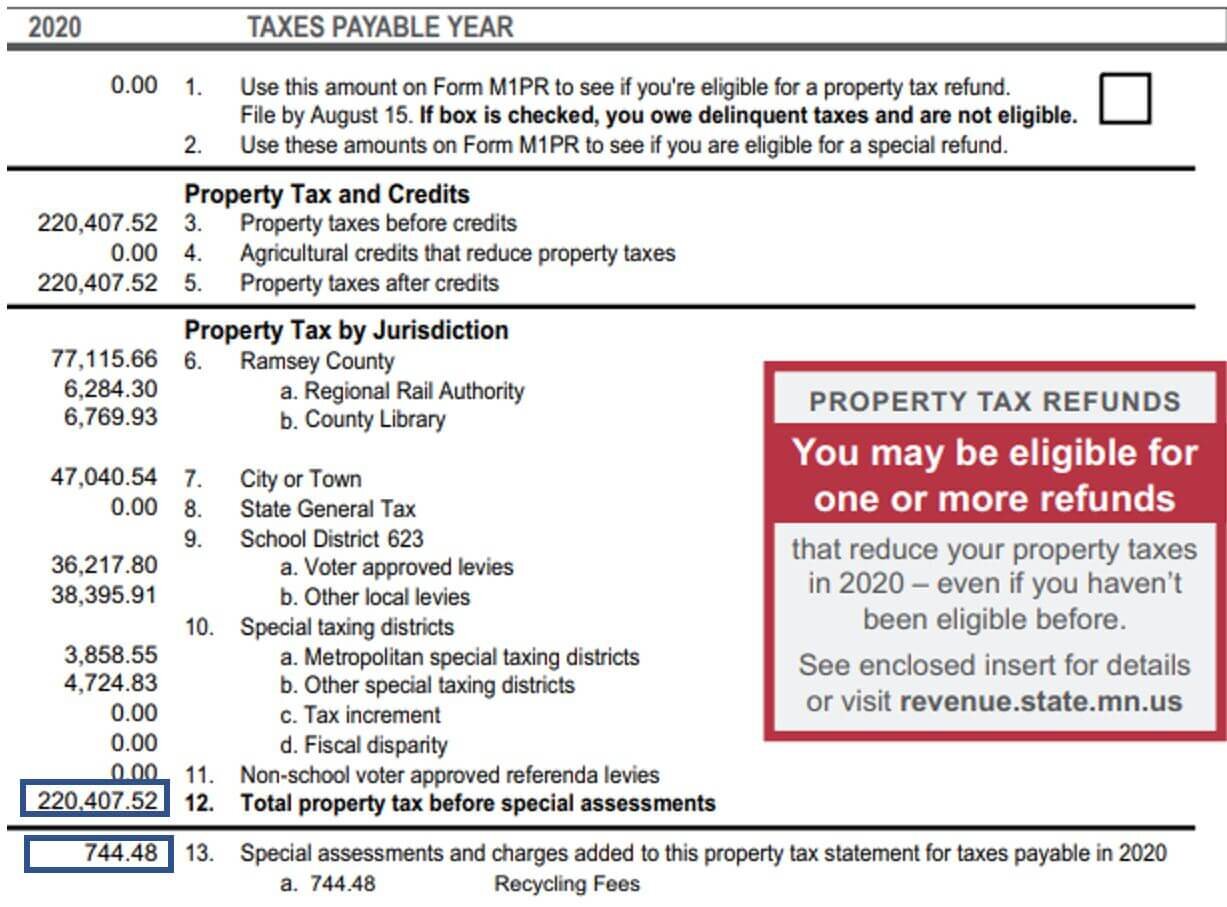

Special evaluations are not component of the tax rates. These assessments may consist of however not restricted to the following: trash collection, weed reductions, sewer fees, upkeep charges, click Mello-Roos, and so on. The calculation of these charges is the obligation of the company that imposes it. These unique analyses are separately recognized in your tax obligation expense by a four-digit code which begins with a 6, 7, 8, as well as in some uncommon occasions with a 9.

The Real Estate Tax Division of the Auditor-Controller's Office (ACO) issues refunds as an outcome of adjustments, appeals, etc that relates to previous years. In many circumstances, these modifications are made by various other divisions entailed in the process various other than the ACO. Generally reimbursements are made within thirty to forty-five days after the monthly refund report is received as well as the required documents to support the refund is gotten.

New building and construction completed in your property. When this occurs, the Assessor's Office reassesses your home. With the exception of the unique evaluation, the tax prices made use of to calculate taxes are rather much consistent.

Comments on “Some Known Incorrect Statements About Special Assessments Florida”